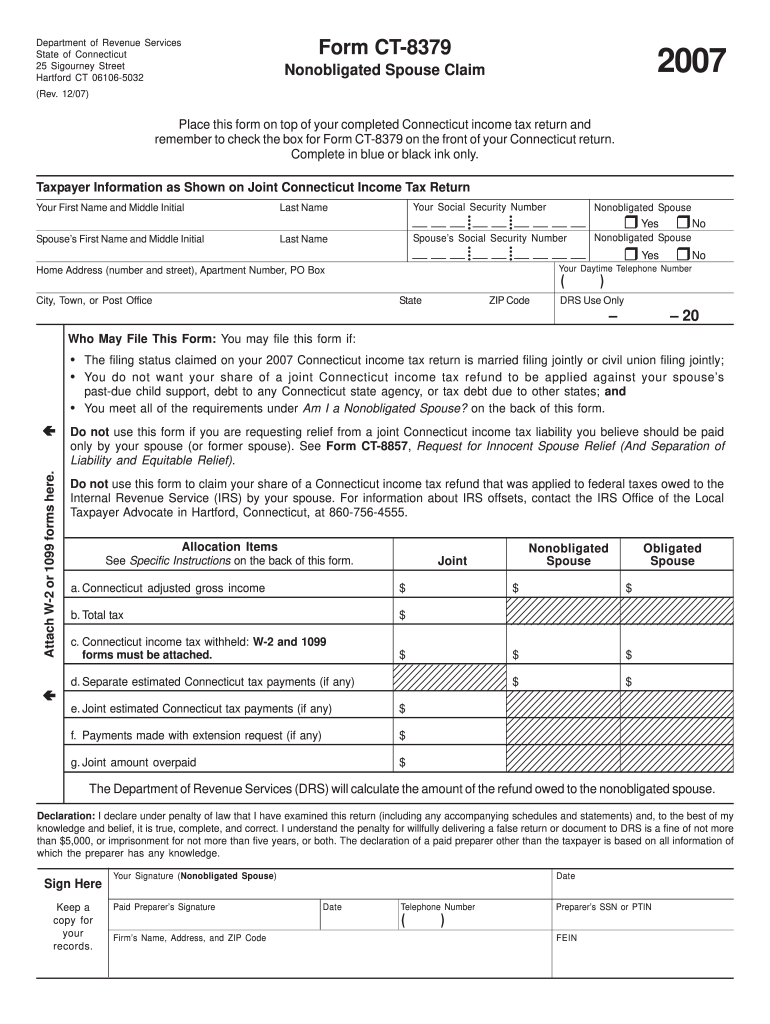

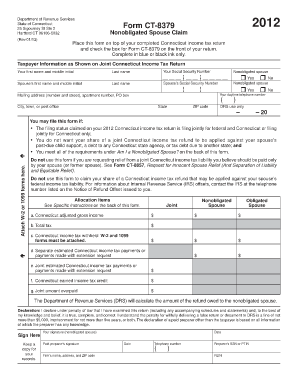

Get the free example of form 8379 filled out

Get, Create, Make and Sign

How to edit example of form 8379 filled out online

How to fill out example of form 8379

How to fill out 8379 form:

Who needs 8379 form:

Video instructions and help with filling out and completing example of form 8379 filled out

Instructions and Help about example of form 8379

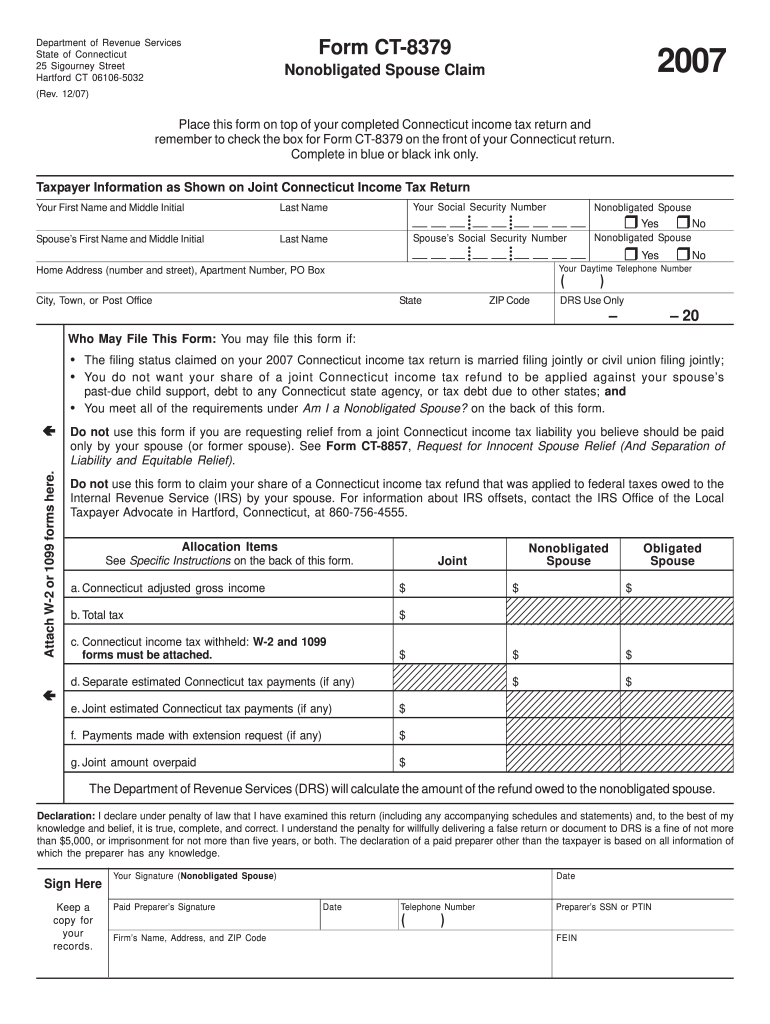

Hi I'm a tax attorney Darrin mesh from Tampa Florida, and I'm here today to answer a question that comes up quite a bit, and it goes like this the person asking says can they take my child support balance from my wife's income tax and furthermore they say here are some facts related to this question it says I was recently married but prior to that I have a child support balance owed can they take this balance from my wife's tax return she has nothing to do with my past tax debt and I don't think that this is fair to her if so I heard from someone about filing your taxes under something called uninjured spouse or something of that nature it would be great to get some insight on this situation thanks in advance, so I think you're exactly right I think that injured spouse actually will be the right thing to do in this case, and it's the form number is form 83-79 you can go to the IRS website at IRS.gov e and click the forms and publications link on the left and then just simply search for form number 83-79, but I thought I would go one step farther here in we'll go ahead and look at the form here's a copy of it and as you can see it says injured spouse allocation and form 83-79 again, and it's pretty straightforward in terms of its one of the easier forms I think to go ahead and fill out there's some yes or no questions and basically what you're doing is you're allocating your income versus your spouses income so let me give you an example if you earn $50,000 a year as a w-2 wage earner, and you had $5000 withheld from airing from your paycheck, and she was an income wage earner, and she had $30,000 of income, and she had three thousand dollars earned or three thousand dollars withheld from her paycheck that would be eight thousand dollars total tax withheld if you're part of the tax debt was 50% and hers was 50×, and actually it's kind of a's not exactly right in the scenario that I gave, but basically they take your proportionate share of the tax refund so let's say your share the tax refund was two thousand dollars or in here sure the tax refund was fifteen hundred dollars you don't get $3,500 back, but it would keep your $2,000, and she would get her $1,500 tax refund back hopefully that answers your question in a nutshell no I mean creditors or the IRS or the or even child support they can't keep your spouse's income tax refund because they're actually innocent in this situation and since there's something else called innocent spouse the IRS had to call something different, so they call it injured spouse and in this case your spouse would in fact be injured if they kept her tax refund so hopefully that answers your question thanks for watching

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your example of form 8379 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.